September 04, 2023

•

5 min read

BlackRock's ETF Move: A Positive Black Swan?

Unpacking seismic shifts in the world of ETFs and Bitcoin.

In early June, Pantera Capital CEO, Dan Morehead, graced the stage at Bloomberg's annual Invest conference in New York. Alongside him was Jay Clayton, the former chairman of the SEC, preceding Gary Gensler. As the talk drew to a close, moderator Carol Massar put forth an intriguing question: What's the 'black swan event' we should be watching for?

Rather than the expected forewarnings, Morehead recalled his times working alongside Nassim Taleb, the Wall Street trader who popularized the term ‘black swan’ with his eponymous book. This term signifies a rare, unforeseen event with substantial impact. Morehead's message? Regulatory clarity might be the unanticipated game-changer nobody sees coming.

By the end of August, Morehead’s prophecy seemed to find validation. Discussions centered around court rulings – notably the SEC’s lawsuit against Ripple Labs and their subsequent defeat, and the unanimous ruling against the SEC in Grayscale's case.

Grayscale, a major player, manages a bitcoin fund, GBTC, allowing investors to delve into bitcoin without the need for direct ownership. Presently, the fund boasts 623,750 BTC, representing over 3% of circulating bitcoins. However, it lacks the mechanism that would enable trading of acquired shares for actual bitcoin, often leading to significant price discrepancies.

Due to these disparities, GBTC isn’t fulfilling its role as an alternative to a spot ETF efficiently. A spot ETF, transparent and straightforward, seamlessly aligns with bitcoin’s current price, providing exactly what investors are seeking.

So why hasn’t such an ETF come into being yet?

The impediment isn't from a lack of applicants. The Winklevoss twins lodged the inaugural application nearly a decade ago. The core rejection reason? The potential for bitcoin price manipulation, necessitating consumer protection. Subsequent applications met the same fate.

Contrarily, the first bitcoin futures ETF received SEC’s approval in 2021, trading exclusively on regulated exchanges, perceived to offer enhanced investor protection. Yet, it doesn't suffice for an investor intent on tracking the pure bitcoin price, a fact made apparent when BlackRock, the world’s largest asset manager, unexpectedly filed for a spot bitcoin ETF in June 2023.

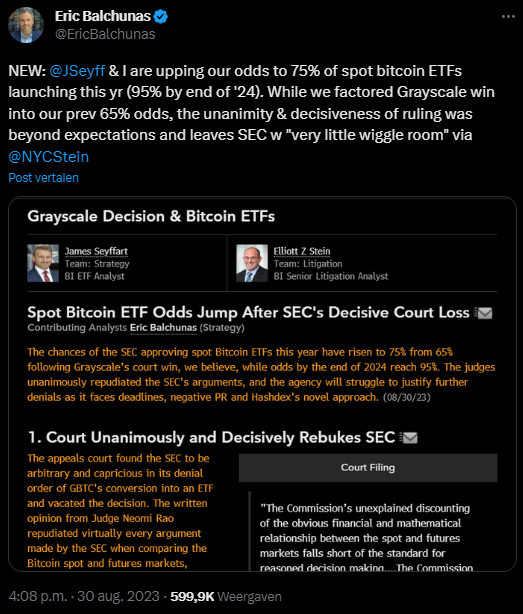

The sentiments bolstered further in the recent ruling favoring Grayscale over the SEC. Grayscale’s underperformance had been a significant concern, leading to the planning of a potential coup by an activist investor group. Amid this, Grayscale's attempts to transform their fund into a spot ETF have consistently been thwarted by the SEC. Yet, recent judgments labeled the SEC’s behavior as “arbitrary and capricious,” shedding light on inconsistencies in their treatment of comparable products.

Revisiting Taleb’s and Morehead’s black swans – one might debate if recent happenings truly fit the bill. However, the unexpected judicial inclination towards the crypto sector, coupled with BlackRock's surprise move, could arguably be considered a ‘positive black swan’.

As existing applications linger awaiting judgment, the SEC has often opted for postponements. However, this might not be the strategy much longer. Bloomberg’s ETF-watchers anticipate a spot bitcoin ETF to emerge this year post-Grayscale's resounding victory. Clayton, coincidentally Morehead’s co-panelist, concurs, considering the approval of a spot bitcoin ETF as "inevitable"